As a high net worth investor, everything on the standard investor page is still relevant to you. We believe simplicity improves your life, and we do not conflate wealth with complexity. However, there are some parts of the investment process where our customized approach can be particularly impactful for high net worth investors.

Taxation is an important issue, and we focus on minimizing it for our clients. Tax mitigation strategies are implemented on your accounts from the start of the investment process. In addition, we work closely with accountants to help navigate often complicated and unclear taxes that may apply to your investments – whether they are of immediate importance or something to be considered down the line.

This service can be of particular help to business owners, who often must navigate a complicated and ever-changing tax system. Whether it is regarding day-to-day operations or creating a plan to unwind or sell a business, we have advisors with vast experience in this area who can help business owners design an efficient strategy and find clarity amid complexity.

Estate planning considerations can be another important part of high net worth investing. When needed, our advisors partner with estate attorneys to make sure your money is set up to perform optimally over a long period of time, helping to ensure your legacy is left the way you intend.

There are several other areas in which we can provide expertise and assistance that are often relevant to high net worth investors. These include managing required minimum distributions (RMDs), college savings planning, cash flow planning and budgeting, risk mitigation, eventual capital disbursement - whether via inheritance or charitable giving, and more.

For high net worth investors interested in environmental investing, we have a dedicated solution.

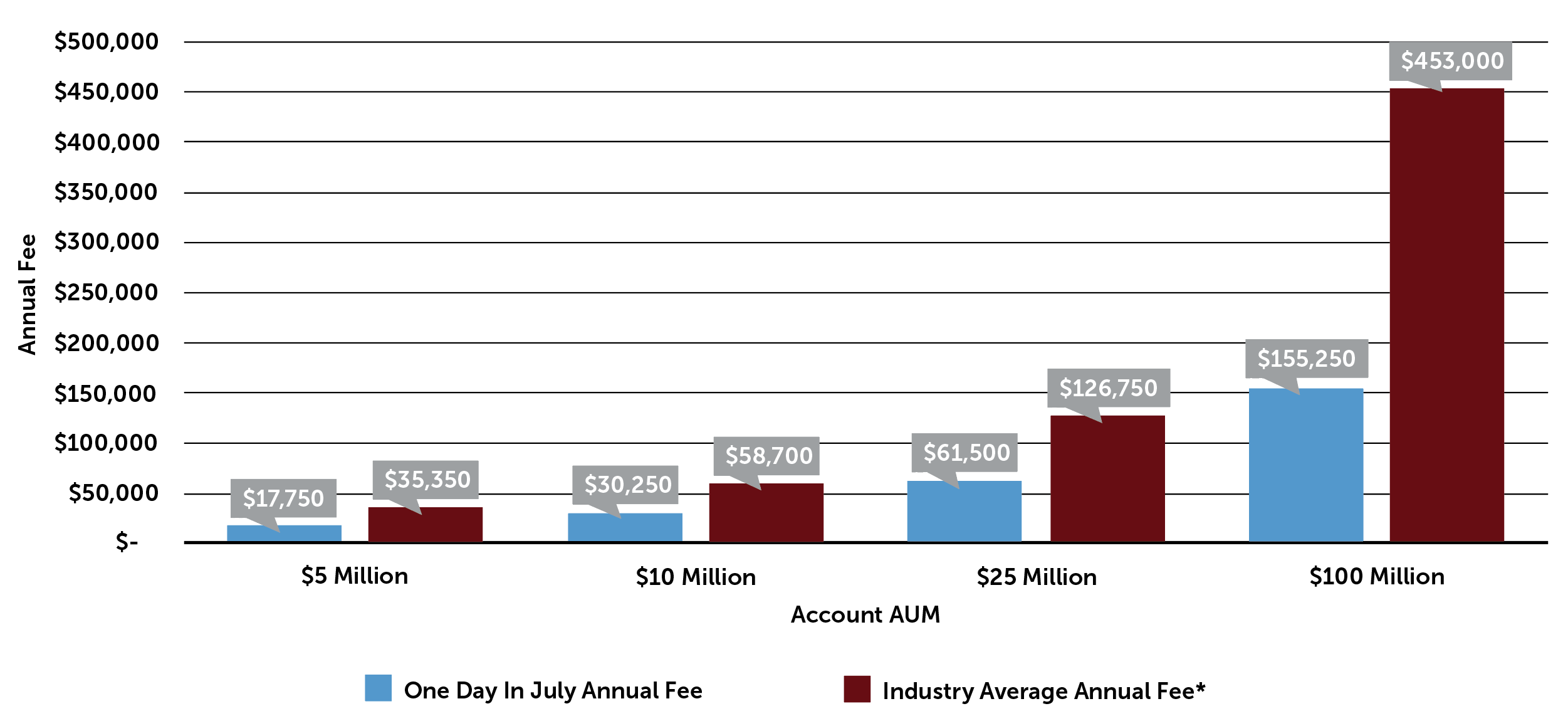

As a high net worth investor, our low fees may be one of the most important pieces of the service we provide. The graphs below demonstrate the One Day In July advisory fee structure as compared to the industry average. Beyond just AUM (assets under management) fees, many firms tack on a variety of other fees that can chop away at your wealth. You can see many of the fees charged by the financial industry here.

*Industry average data source:

https://www.advisorhub.com/fee-compression-a-myth-advisory-fees-tick-up-after-years-of-decline/

Get Started Today.