"When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds."

- Warren Buffett, Berkshire Hathaway1

Investment consultants and managers may struggle to justify their fees when results are compared against the appropriate baseline indexing strategy, controlled for risk. We believe it is time for the financial industry to stop enriching itself excessively at the expense of America's non-profit institutions and their employees.

Our institutional investing program begins with a promise to always be transparent. We will not mislead you: institutional investing is large and hence seen as a potent source of revenue by financial firms. But we do not believe, in general, the fees taken are justified by performance.

The best way to understand the fees and opportunity costs your institution has been paying is to have us run a simulation of your current program against the low-cost indexing approach. If a gap exists, and you are not satisfied with the explanation, a switch may be in order.

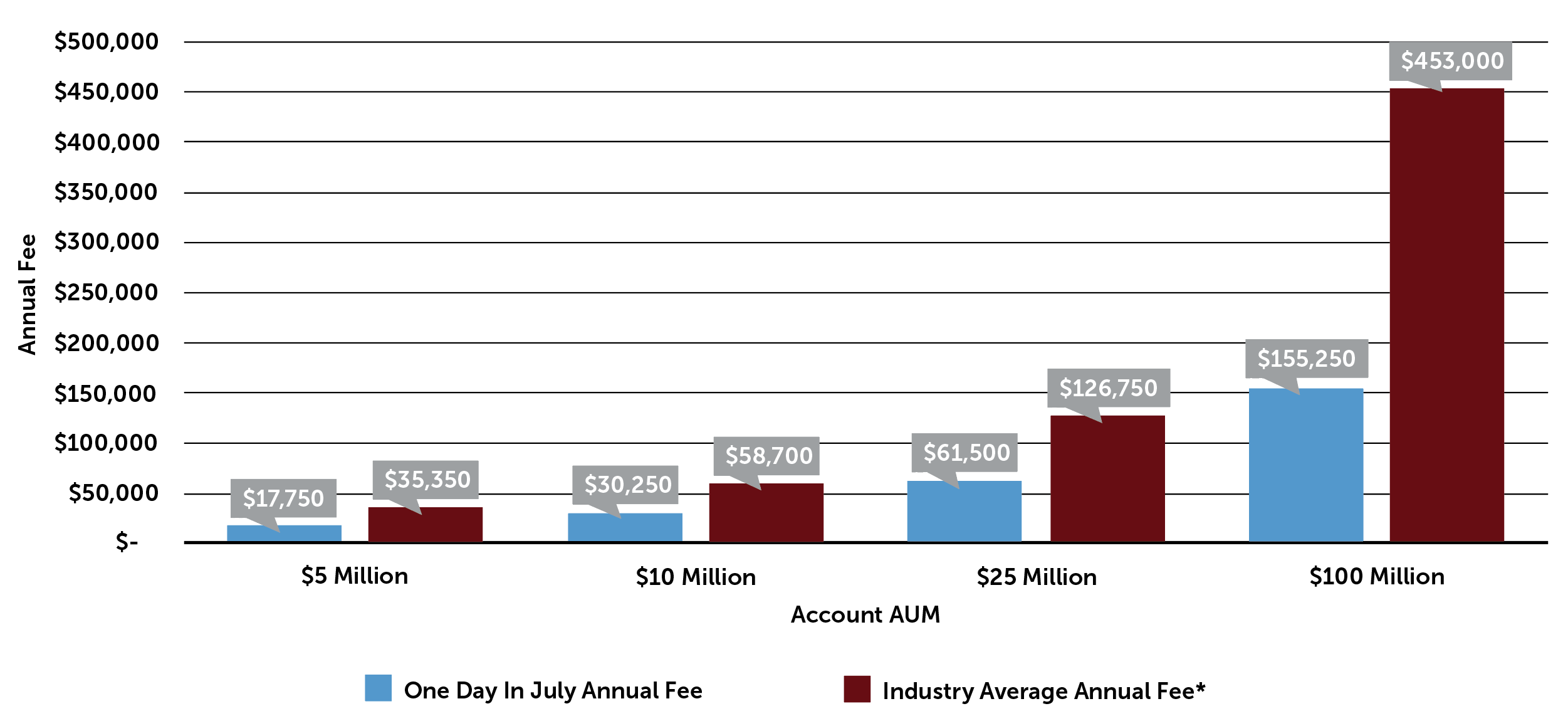

As an institutional investor, fee structures are something you need to be keenly aware of. The graphs below demonstrate the One Day In July advisory fee structure as compared to the industry average. Beyond just AUM fees, many firms tack on a variety of other fees that can chip away at your wealth. You can see many of the fees charged by the financial industry here.

We execute traditional and environmentally-focused investment approaches.

Finally, we recommend that you read this article about institutional investing of Carthage College (indexers) vs Harvard University (not indexers).

Our Shelburne, VT Financial Advisors have vast experience with institutional investing. Learn more here.

*Industry average data source:

https://www.advisorhub.com/fee-compression-a-myth-advisory-fees-tick-up-after-years-of-decline/

1Berkshire Hathaway Inc.

Get Started Today.